Bayment - Overcoming the Challenges of Cross-Border Payments in Ethiopia

Ethiopia, a country of immense potential and a rapidly growing digital landscape, faces significant challenges when it comes to cross-border payments

Ethiopia cross-border payments

Currently, there are no widely available payment cards within Ethiopia that support international transactions. This limitation creates barriers for Ethiopian individuals, entrepreneurs, and businesses, preventing them from accessing the global marketplace and vital services such as e-commerce, digital advertising, and online business solutions.

The Problem: Limited Cross-Border Payment Options

Without access to internationally accepted payment cards, Ethiopians are deprived of opportunities that the rest of the world takes for granted. From a consumer perspective, the inability to make cross-border transactions means missing out on online shopping, paying for digital subscriptions, or accessing premium services. For business owners and entrepreneurs, this challenge is even more pronounced. Developers struggle to pay for essential tools such as hosting services, domain registration, or even marketing campaigns that require digital payments.

This gap has been partially filled by independent card providers, but these come with significant drawbacks. Many of these services charge exorbitant fees and offer unfavorable exchange rates, which leads to inflated costs. Worse still, some are unregulated and pose a risk of fraud, leaving many Ethiopians vulnerable to being scammed or receiving substandard service.

The Solution: Bayment's Approach to Cross-Border Payments To address this issue, Bayment steps in as a comprehensive solution. Bayment offers an affordable and secure way to facilitate cross-border payments for Ethiopians, providing a much-needed alternative to the high-cost, high-risk options currently available. Here’s how Bayment stands apart:

Affordable Exchange Rates: Unlike many other card providers who exploit the gap by charging unreasonable conversion fees, Bayment offers rates close to the bank exchange rate, ensuring transparency and fairness.

Low Service Fees: While other providers may charge hefty fees for each transaction, Bayment delivers a service that is affordable, helping users save money on international payments.

Licensed and Regulated: Bayment is a legally registered and licensed company based in the UK under the business name Bayment LTD, with a registered office at Unit A, 82 James Carter Road, Mildenhall, Suffolk, United Kingdom, IP28 7DE. This legitimacy ensures accountability, giving users peace of mind when using Bayment for their cross-border payment needs.

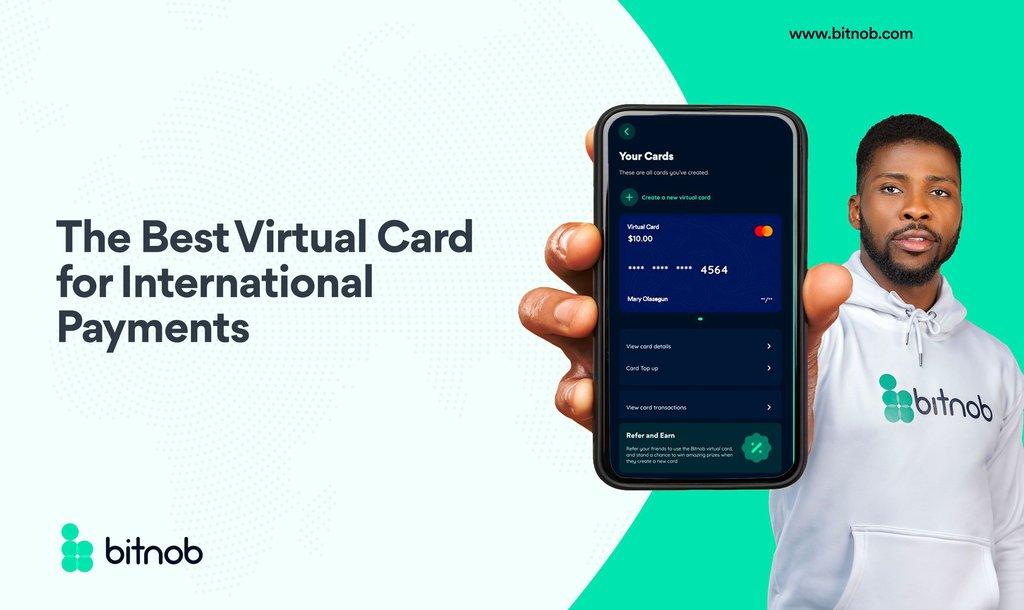

Seamless User Experience: Bayment’s app makes the process of obtaining an internationally accepted Visa card as simple as downloading the app, verifying your identity in minutes, and funding your card using Ethiopian Birr. Users can make payments online with ease, accessing global platforms and services without the usual friction of cross-border transactions.

Zuber Ibrahim

CTO

No comments yet. Login to start a new discussion Start a new discussion